Annual Rates

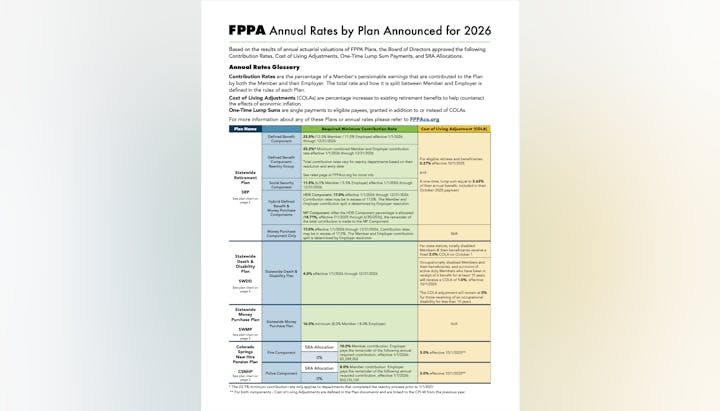

Based on the results of the most recent actuarial valuations of FPPA Plans, the FPPA Board of Directors approved the Funded Ratios, Contribution Rates, IRS Contribution Limits, Cost of Living Adjustments, One-Time Lump Sums, and SRA Allocations below.

The Funded Ratio is a pension fund's current financial position, showing assets as a percentage of liabilities. It is common measure of a fund's ability to pay all promised benefits to current and future members.

Statewide Retirement Plan

Funded Ratio: 100.0%, effective 1/1/2025

This valuation applies to the following components:

- Defined Benefit Component

- Hybrid Defined Benefit Component

- Social Security Component

Statewide Death & Disability Plan

Funded Ratio: 91.4%, effective 1/1/2025

Colorado Springs New Hire Pension Plan

- Fire Component: 84.5%, effective 1/1/2025

- Police Component: 88.6%, effective 1/1/2025

Members of FPPA's Death & Disability and retirement plans, and their Employers, make monthly payroll contributions to fund the Plans. The amount Members and their Employers contribute varies by Plan.

Statewide Death & Disability Plan

The Statewide Death & Disability Plan contribution rate is 4.0% for the period of January 1, 2026 through December 31, 2026. Contributions can be paid by Members, Employers, or split between the two. This contribution split is a local decision.

The Board may adjust the Statewide Death & Disability Plan required contribution rate annually by a maximum of 0.2%.

Statewide Retirement Plan

Defined Benefit Component

Contribution rates for the Defined Benefit Component are set by state statute. Employer contribution rates can be amended by state statute or by election of both the Employers and Members. Member contribution rates can be amended by state statute or by election of the membership.

Changes to Contributions Through 2030

Members elected in 2014 to increase the Member contribution rate beginning in 2015. Member contribution rates increased 0.5% annually through 2022 to a total of 12% of pensionable earnings. Member contributions will remain at 12% for the foreseeable future.

Recent legislation mandated a similar increase in Employer contributions beginning in 2021. Employer contribution rates will increase 0.5% annually through 2030 to a total of 13% of pensionable earnings. The Employer contribution rate for 2026 is 11.0%.

Reentry Members to the Defined Benefit Component

Contribution rates for Members and Employers of departments reentering the system are established by resolution. Prior to January 1, 2021, the reentry group paid an additional 4% continuing rate of contribution, with the split of that rate decided locally. Within the 2014 Member election and legislation referenced above, required Member contributions for the reentry group also increased 0.5% annually through 2022, and Employer contributions will increase by 0.5% annually through 2030.

Effective January 1, 2021, the continuing rate of contribution for departments that completed the reentry process prior to 2021 is 0.2% of pensionable earnings. Those departments, by resolution, may reduce the 4% continuing rate of contribution to 0.2% if desired. Going forward, departments who complete the reentry process will have the continuing rate of contribution set at 1.9% of pensionable earnings. This rate is reevaluated after two years of experience, when it may stay the same or be decreased.

Social Security Component

Following the 2014 Member election, Member contributions for the affiliated social security group also increased 0.25% annually beginning in 2015 through 2022 to a total of 6% of pensionable earnings. Member contributions in this component will remain at 6% for the foreseeable future.

Legislation passed in 2020 requires an Employer contribution increase of 0.25% annually through 2030 to a total of 6.5% of pensionable earnings. The Employer contribution rate for 2026 is 5.5%.

Hybrid Defined Benefit and Money Purchase Components

In 2026, the required minimum contribution for the Hybrid Defined Benefit and Money Purchase Components is 17.0% of the Member’s pensionable earnings, with a minimum rate of 8.5% each for Members and Employers. Of the required minimum, a portion goes towards the Hybrid Defined Benefit Component and the remainder is contributed to the Money Purchase Component of the Plan. If a department has a higher contribution rate, any amount above the required minimum goes towards the Money Purchase Component.

Effective July 1, 2025 through June 30, 2026, the Hybrid Defined Benefit Component contribution rate is 14.71%. After this contribution is allocated to the Hybrid Defined Benefit Component, the remainder of the total contribution rate is then directed to the Money Purchase Component.

Changes to Contributions Through 2030

Legislation passed in 2022 increases the required minimum contribution by a total of 2% over eight years, to a combined contribution rate of 18%, split evenly between Member and Employer.

Money Purchase Component Only

The 2026 required minimum contribution for the Money Purchase Component is 17.0%, with a minimum rate of 8.5% each for Members and Employers.

Colorado Springs New Hire Pension Plan

Police Component

Per the January 1, 2025 actuarial valuation, the Police Component member contribution rate is 8% of basic salary and the employer remits the remainder of the $10,176,139 annual required contribution effective 1/1/2026.

Fire Component

Per the January 1, 2025 actuarial valuation, the Fire Component member contribution rate is 10% of basic salary and the employer remits the remainder of the $5,289,202 annual required contribution effective 1/1/2026.

Statewide Money Purchase Plan

The Statewide Money Purchase Plan mandatory combined contribution rate remains set at 16% (8% Member and 8% Employer).

2026 Contribution Limits

457 Deferred Compensation Plan

- $24,500 This limit includes both employee and employer contributions

Three Ways to Catch-Up on 457 Contributions

-

Age 50+ Catch-up | IRS Annual Contribution Limit of $8,000

- Beginning in the year the member turns age 50, they can make additional annual catch-up contributions to the FPPA 457 Deferred Compensation Plan

-

Age 60-63 Catch-up | IRS Annual Contribution Limit of $11,250

- In years when Members are age 60, 61, 62, or 63 on December 31, their maximum catch-up contribution remains $11,250

-

3 Year Catch-up | IRS Annual Contribution Limit of $49,000

- This provision allows Members the potential to double their 457 contributions when they are within three full calendar years of the Normal Retirement age specified by their retirement plan

Statewide Money Purchase Plan and Statewide Retirement Plan: Money Purchase

- $72,000 This limit includes both Member and Employer contributions

Cost of Living Adjustments (COLAs) to FPPA’s plans are determined by the Board of Directors each year (with the exception of the Colorado Springs New Hire Pension plans – see below). These are sometimes referred to as Benefit Adjustments. COLAs are not guaranteed and are granted based upon what a plan can afford to pay under its current funded status. COLAs for the current year are evaluated in June, and if approved are effective with payees' October benefit payment.

Learn more about FPPA’s COLA policy for the Statewide Retirement Plan on our blog.

Statewide Death & Disability Plan

Totally Disabled Members and their Beneficiaries

By law, totally disabled Members and their beneficiaries are granted a fixed 3% benefit adjustment each year on October 1. Those who began receiving benefits by October 1, 2024 received this increase beginning in their October 2025 benefit payment.

Occupationally Disabled Members and their Beneficiaries, and Survivors of Active Duty Members

Occupationally disabled Members and their beneficiaries, and survivors of active duty Members may be granted a benefit adjustment at the Board’s discretion. The Board takes into account many factors when granting a benefit adjustment. One of those factors is maintaining the funded status of the plan (91.4% as of January 1, 2025) to ensure all benefits can be paid. The Board decided that occupationally disabled Members, their beneficiaries, and survivors of active duty Members who have been in receipt of an occupational disability benefit for at least 15 years would receive a benefit adjustment of 1.0%, effective 10/1/2025 through September 30, 2026. The benefit adjustment will remain at 0% for those receiving an occupational disability for less than 15 years.

Statewide Retirement Plan

Defined Benefit, Hybrid Defined Benefit, and Social Security Components

Statewide Retirement Plan retirees and beneficiaries received a benefit adjustment of 0.27% effective October 1, 2025, through September 30, 2026. This adjustment is in addition to any one-time lump sum payments described below.

Colorado Springs New Hire Pension Plan

Effective October 1, 2025 through September 30, 2026, the following Cost Of Living Adjustments are implemented for retirees of the Colorado Springs New Hire Pension Plans: payees in both the Fire Component and Police Component will receive a 3.0% COLA. The FPPA Board of Directors do not establish Cost of Living adjustments for either Colorado Springs New Hire Pension Plans. For both components of the Colorado Springs New Hire Plan, Cost Of Living Adjustments are linked to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) from the previous year.

FPPA's Board may consider a non-compounding, one-time lump sum payment in years where the national inflation rate is higher than the compounding COLA that the Plan can afford. This one-time lump sum would be in addition to any awarded compounding COLA. one-time lump sum payments for the current year are evaluated in June, and if approved are effective with payees' October benefit payment.

The Board can consider granting one-time lump sum payments to eligible retirees under these conditions:

- If the compounding COLA is less than 1%, and

- The long-term investment pool (where FPPA invests Plan assets) has achieved an average return of 6.5% over the last five years

- Then, pay a one-time lump sum that equals:

- (CPI-W inflation rate – the compounding COLA) x the Member’s annual benefit

Statewide Retirement Plan

Effective October 2025, eligible retirees in the Statewide Retirement Plan received a one-time lump sum payment equal to 2.63% of the Member’s annual benefit. This sum was calculated by subtracting the approved compounding COLA (0.27%) from the previous year’s CPI-W inflation rate (2.9%).

Legislation passed in 2020 required FPPA to convert existing Separate Retirement Account (SRA) balances to individual, self-directed defined contribution accounts held at Fidelity Investments®. This conversion is now complete. More information about the changes can be found in these resources: